A string of disappointing earnings results has sparked large declines in the stock prices of multiple fast casual food companies, including Cava Group Inc., Sweetgreen Inc., Shake Shack Inc., Chipotle Mexican Grill Inc. This has raised questions about the state of consumption as the US economy absorbs tariffs and job growth slows. So although the overall data on spending suggests there’s nothing to panic about just yet, the geographic footprint of some of those chains provides some answers.

In short, these companies are overexposed to critical coastal metro areas that are immigration hubs and popular international tourism destinations, as well as overwhelmingly Democratic places in an environment where economic sentiment among that political group has soured to record lows. The fast casual restaurant industry may be the real key in solving the puzzle for how the US consumer appears resilient even though government policies are dissuading foreigners from entering the US.

The first three of those fast casual chains -- Cava, Sweetgreen and Shake Shack -- are noteworthy because they're overrepresented in some combination of the metros of New York City, the District of Columbia and California. Cava is headquartered in DC and has 17% of its locations there and in Maryland and Virginia. More than a third of Sweetgreen's locations are in New York or California. About 80 of Shake Shack's 610 locations are in the New York metro area.

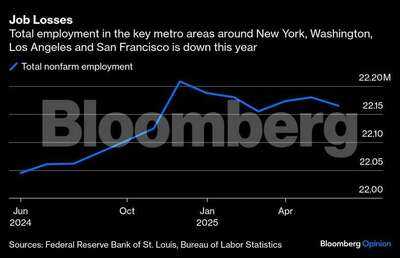

The locations are significant because year-to-date through June, the metros of New York, DC, Los Angeles, and San Francisco have collectively lost 43,000 jobs while the US overall added more than 500,000. All else equal, places with less job creation are going to see less dining out activity and less consumption in general. The labor force in those four metros has shrunk by 60,000 people year-to-date after increasing by 160,000 in 2024, suggesting that the decline in immigration is having an impact.

It's fair to ask whether newly arrived immigrants are really the kinds of customers that Cava and Sweetgreen are missing. For them, the slump in international tourism likely matters more. We've seen this most clearly in Las Vegas, where the decline in international visitors is part of the reason why there's been an overall drop in tourists. Tourism from Canada has been particularly weak, with the number of Air Canada passengers to Las Vegas cratering 33% in June relative to a year earlier.

It's fair to ask whether newly arrived immigrants are really the kinds of customers that Cava and Sweetgreen are missing. For them, the slump in international tourism likely matters more. We've seen this most clearly in Las Vegas, where the decline in international visitors is part of the reason why there's been an overall drop in tourists. Tourism from Canada has been particularly weak, with the number of Air Canada passengers to Las Vegas cratering 33% in June relative to a year earlier.

New York and California are feeling the impact as well. New York City Tourism + Conventions cut its forecast for international tourists this year by 17%, which would mean two million fewer such visitors than in 2024. Visit California projected a 9.2% decline in international visits for the state this year. Tourists don't get jobs, but they do eat.

In its earnings report, Shake Shack noted that "same-Shack sales" in both New York City and the northeast were down 2% versus mid-single digit growth in other regions. Sweetgreen Chief Executive Officer Jonathan Neman said most of his company’s weakness was in "urban Northeast environments."

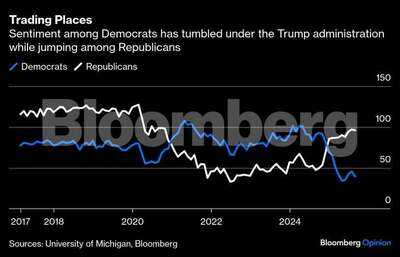

This is happening at a time when consumer sentiment among Democrats is in the dumps. The preliminary University of Michigan Consumer Sentiment survey for August showed that the mood among Democrats has really never been lower, with liberal-leaning workers in coastal metros perhaps not feeling good enough about what lies ahead to splurge on a $17 Sweetgreen salad bowl. The strongest same-store sales performances among food services establishments last quarter included Olive Garden, Longhorn Steakhouse, and Texas Roadhouse, places more geographically diversified and with more of a middle America customer base.

The diverging fortunes of various dining chains help solve some of the riddles that have emerged in the economy. The big banks that track consumer spending via credit card data show a consumer that remains relatively resilient. Job growth has slowed significantly, though at a time when immigration has essentially come to a halt. And many economists argue the slowdown doesn't necessarily portend overall weakness.

The diverging fortunes of various dining chains help solve some of the riddles that have emerged in the economy. The big banks that track consumer spending via credit card data show a consumer that remains relatively resilient. Job growth has slowed significantly, though at a time when immigration has essentially come to a halt. And many economists argue the slowdown doesn't necessarily portend overall weakness.

The decline in both immigration and international tourism has had very real impacts, with some areas of the country affected much more than others. And at a time when the US remains as politically polarized as ever, consumer sentiment among Republicans is far higher than it is among Democrats, suggesting that conservative-leaning consumers are in more of a spending mood than urban, liberal-leaning ones at the moment.

The message from these earnings reports is that the US economy isn’t a monolith, particularly when it comes to the consumer. We’ve seen bifurcations between high- and low-income consumers, and similarly, there’s a divergence in dining trends between places more reliant on international visitors and those more anchored in middle America. So far, that international weakness hasn’t been enough to cause a downturn in the overall economy, but don’t tell that to a restaurant operator in Manhattan or Las Vegas.

In short, these companies are overexposed to critical coastal metro areas that are immigration hubs and popular international tourism destinations, as well as overwhelmingly Democratic places in an environment where economic sentiment among that political group has soured to record lows. The fast casual restaurant industry may be the real key in solving the puzzle for how the US consumer appears resilient even though government policies are dissuading foreigners from entering the US.

The first three of those fast casual chains -- Cava, Sweetgreen and Shake Shack -- are noteworthy because they're overrepresented in some combination of the metros of New York City, the District of Columbia and California. Cava is headquartered in DC and has 17% of its locations there and in Maryland and Virginia. More than a third of Sweetgreen's locations are in New York or California. About 80 of Shake Shack's 610 locations are in the New York metro area.

The locations are significant because year-to-date through June, the metros of New York, DC, Los Angeles, and San Francisco have collectively lost 43,000 jobs while the US overall added more than 500,000. All else equal, places with less job creation are going to see less dining out activity and less consumption in general. The labor force in those four metros has shrunk by 60,000 people year-to-date after increasing by 160,000 in 2024, suggesting that the decline in immigration is having an impact.

New York and California are feeling the impact as well. New York City Tourism + Conventions cut its forecast for international tourists this year by 17%, which would mean two million fewer such visitors than in 2024. Visit California projected a 9.2% decline in international visits for the state this year. Tourists don't get jobs, but they do eat.

In its earnings report, Shake Shack noted that "same-Shack sales" in both New York City and the northeast were down 2% versus mid-single digit growth in other regions. Sweetgreen Chief Executive Officer Jonathan Neman said most of his company’s weakness was in "urban Northeast environments."

This is happening at a time when consumer sentiment among Democrats is in the dumps. The preliminary University of Michigan Consumer Sentiment survey for August showed that the mood among Democrats has really never been lower, with liberal-leaning workers in coastal metros perhaps not feeling good enough about what lies ahead to splurge on a $17 Sweetgreen salad bowl. The strongest same-store sales performances among food services establishments last quarter included Olive Garden, Longhorn Steakhouse, and Texas Roadhouse, places more geographically diversified and with more of a middle America customer base.

The decline in both immigration and international tourism has had very real impacts, with some areas of the country affected much more than others. And at a time when the US remains as politically polarized as ever, consumer sentiment among Republicans is far higher than it is among Democrats, suggesting that conservative-leaning consumers are in more of a spending mood than urban, liberal-leaning ones at the moment.

The message from these earnings reports is that the US economy isn’t a monolith, particularly when it comes to the consumer. We’ve seen bifurcations between high- and low-income consumers, and similarly, there’s a divergence in dining trends between places more reliant on international visitors and those more anchored in middle America. So far, that international weakness hasn’t been enough to cause a downturn in the overall economy, but don’t tell that to a restaurant operator in Manhattan or Las Vegas.

You may also like

Spurs' Mikey Moore makes huge claim, Will Lankshear praise as Alejo Veliz and Alfie Devine score

Govt forming separate authority for industrial focal points: Punjab minister

'Pak denied involvement but ...': NCERT releases special module on Operation Sindoor; curriculum for classes 3 to 12

Brookside child star unrecognisable 22 years after soap exit and where you have seen him recently

Nigel Farage breaks silence as migrant hotel ordered to remove asylum seekers