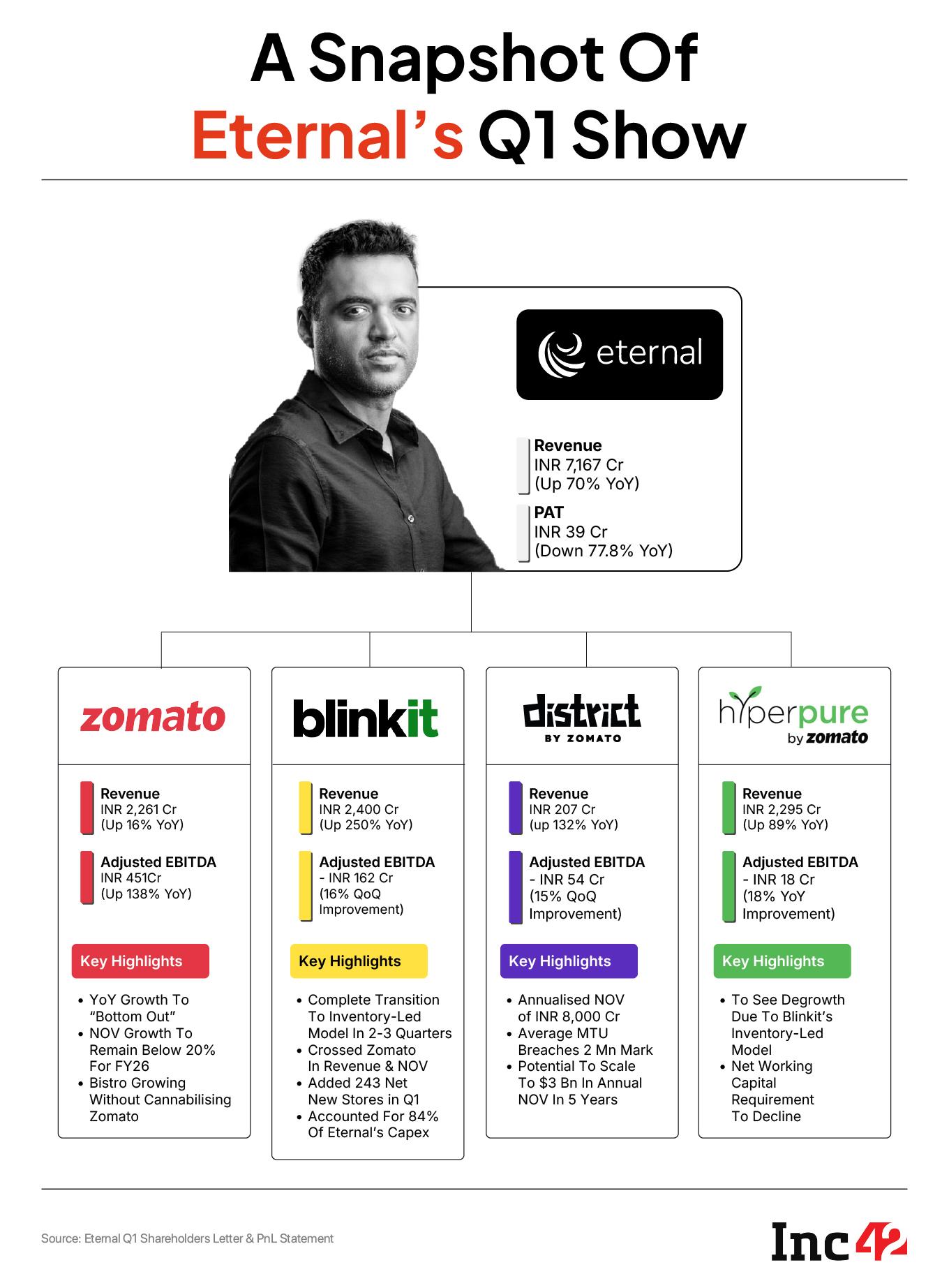

Zomato parent Eternal’s consolidated net profit for the first quarter of FY26 slid over 90% to INR 25 Cr from INR 253 Cr in the same quarter of previous year as the company continued to make investments in its quick commerce vertical Blinkit. Sequentially, the company’s profit declined 36% from INR 39 Cr.

The decline in profit came despite the company’s operating revenue surging over 70% to INR 7,167 Cr during the quarter under review from INR 4,206 Cr in the year-ago quarter. On a QoQ basis, Eternal’s top line increased 23% from INR 5,833 Cr.

Including other income of INR 354 Cr, total income for the period rose 69% YoY to INR 7,521 Cr. Meanwhile, its expenses surged to INR 7,433 Cr, marking a 77% YoY and 22% QoQ jump.

Minus the other income, the company would have reported a loss of about INR 330 Cr in the quarter. Eternal’s adjusted EBITDA declined 42% YoY to INR 172 Cr in the quarter.

Explaining the QoQ decline in the food delivery business, CEO Deepinder Goyal said, “Every year in Q1, margins get impacted (in both food delivery and quick commerce) because of lower availability of delivery partners due to festivals and adverse weather conditions (onset of summer and rains in different parts of the country). In the past, in the food delivery business, this pressure on margins in Q1s used to be offset by improvement in other areas; but now that margins have matured in this business, such fluctuations driven by seasonal factors are possible.”

Now, let’s take a detailed look at how the company’s key verticals – food delivery, quick commerce, going-out – fared in the first three months of FY26.

Q1 FY26 was the first fiscal quarter where Eternal’s quick commerce arm Blinkit outpaced the company’s bread-and-butter food delivery segment in contribution to its top line. The quick commerce arm’s operating revenue for the quarter stood at INR 2,400 Cr, recording an over 2.5X growth from INR 942 Cr in Q1 FY25.

In the quarter, Blinkit’s loss stood at INR 42 Cr as against a profit of INR 43 Cr in Q1 FY25. However, on a QoQ basis, the segment’s loss reduced by 49% from INR 82 Cr in the previous quarter. Its adjusted EBITDA loss also reduced by 9% on a sequential basis to INR 162 Cr from INR 178 Cr in Q4 FY25.

Blinkit’s net order value (NOV), too, zoomed past Zomato’s, rising 127% YoY and 25% QoQ to INR 9,203 Cr. The quick commerce arm’s average monthly transacting customers (MTC) grew 123% YoY to 1.7 Cr during the quarter.

Blinkit added 243 net new stores in Q1, taking its store count to 1,544. CEO Albinder Dhindsa said that Blinkit is on track to set up 2,000 stores by December 2025. Moving forth, Eternal expects the number of dark stores to reach 3,000. However, Dhindsa didn’t share a timeline for the same.

On the losses of the business, the CEO said that the margins have “bottomed out”. “In fact, even the absolute losses should come down from hereon. But the margin improvement journey may not be linear and there could be some bumps along the way if the competitive intensity goes-up again for whatever reason,” he added.

It is pertinent to mention that of the INR 370 Cr capex incurred by Eternal in the quarter, about INR 310 Cr was on account of the expansion of its quick commerce store and warehouse network.

As Blinkit prepares to move to an inventory-led model from a marketplace model, Eternal CFO Akshant Gupta said that the control on inventory would give Blinkit more leverage on margins in the business and allow it to push harder and faster on assortment expansion. The company expects to see about 1 percentage point margin expansion over time, as a result of this transition.

The company expects to complete the transition to the owned inventory model in the next 2-3 quarters.

Eternal also said that it plans to incorporate a new subsidiary, Blinkit Foods. The subsidiary would be engaged in the business of providing food services (including innovation, preparation, sourcing, sale and delivery of food to customers).

Another Sluggish Quarter For ZomatoAs Blinkit takes the centre stage in Eternal’s growth story, its food delivery vertical Zomato continues to report steady growth. The food delivery business reported an operating revenue of INR 2,261 Cr in Q1 FY26, up 16% from INR 1,942 Cr in the same quarter previous year. Zomato’s adjusted EBITDA rose to INR 451 Cr during the quarter under review from INR 313 Cr in the year-ago quarter and INR 428 Cr in the March quarter.

However, the YoY NOV growth for the business remained subdued at 13%, rising to INR 8,967 Cr. Average monthly users for the vertical stood at 2.3 Cr, up 13% YoY. For Eternal, Zomato is now the vertical seeing the least growth.

On the growth prospect of Zomato moving forward, Goyal said that the YoY growth of the vertical is likely “to bottom out” now as it recovers from a demand slowdown experienced since late last year. He doesn’t expect the business to churn out over 20% NOV growth for the ongoing fiscal year.

“In response to the sluggish demand environment, we saw a QoQ increase in restaurant funded discounts (as a % of GOV) in Q1FY26, which led to the slightly lower NOV growth with respect to GOV growth during the quarter. We expect such quarterly fluctuations to be a regular feature as restaurants calibrate their investments in discounts in response to changes in the demand environment,” he added.

Notably, Zomato saw a change in leadership recently, with head of product Aditya Mangla taking over as its new CEO.

While Zomato continued to see weaker growth, a silver lining for the food delivery business of Eternal was the growth of Blinkit’s 10-minute food delivery service Bistro.

Goyal said that the 10-minute vertical is registering growth without cannibalising Zomato’s business. While the business is gaining early traction, the company is also seeing higher losses due to it, adding up to the bottom line of its ‘Other’ segments losses.

The segment registered a loss of INR 45 Cr in the quarter as against a profit of INR 1 Cr in the year-ago quarter. The losses come against an adjusted revenue of INR 4 Cr in the quarter, down 73% from INR 15 Cr in Q1 FY25. In the quarter, Eternal’s capex stood at INR 60 Cr for investments in Bistro.

Hyperpure Growth To Take A HitAs of now, Bistro is operating 38 kitchens in Delhi NCR and Bengaluru. Eternal said it plans to invest INR 150 Cr in Bistro, AI-native, no-code customer support platform Nugget, and Greening India initiative.

Although Eternal’s B2B arm Hyperpure has been a steady workhorse for its top line over the past few quarters, the company is expecting to see a degrowth in the business moving forward.

In Q1, Hyperpure’s operating revenue grew 89% to INR 2,295 Cr from INR 1,212 Cr in the year-ago quarter. The company also managed to trim its loss from INR 14 Cr in Q1 FY25 to INR 5 Cr in the quarter ended June.

However, this growth trajectory is set to change. “We expect de-growth in this business in the next few quarters,” Eternal CFO Akshant Goyal said.

Eternal expects Hyperpure’s non-restaurant business to take a hit on its revenue as Blinkit moves to an inventory model.

“As an outcome of this transition (to the inventory-led model), we will also see shrinkage in Hyperpure’s non-restaurant business as most of the B2B buyers in that business were sellers on our quick commerce platform,” CFO Goyal said.

District Can Be A $3 Bn NOV Business“I am excited about where we have gotten to in this business, and the journey that lies ahead,” Eternal CEO said on its youngest app District. Goyal said that due to District, the company’s going-out vertical has an annualised NOV of INR 8,000 Cr and is growing at a 30% YoY.

The app, which allows users to book for dining-out, movies, sports, concert ticketing, among others, has seen over 1 Cr downloads on the Google Play Store since its launch in November 2024.

In the quarter, District’s average monthly transacting users surged to 2 Mn, with users transacting twice a month on average.

“Our average revenue per order today is INR 160+, which is meaningfully higher than our food delivery and quick commerce businesses. If we execute well, this business has the potential to scale to $3 Bn in annual top line (NOV) with $150 Mn of adjusted EBITDA sometime over the next five years,” the CFO said.

However, it is currently a heavy burn business for the company. While going out’s operating revenue zoomed 132% YoY to INR 207 Cr during the quarter, it reported a loss of INR 48 Cr. The quarterly burn was higher than the INR 30 Cr loss incurred by the business in the entire FY25.

Shares of Eternal ended today’s trading session 5.38% higher at INR 271.20 on the BSE. The company also allotted over 10 Lakh ESOPs to employees.

[Edited by: Vinaykumar Rai]

The post Eternal Q1 Profit Slides 90% To INR 25 Cr appeared first on Inc42 Media.

You may also like

Tyson Fury makes offer to Daniel Dubois after Oleksandr Usyk KO defeat

How to Take Care of Your Car During the Rainy Season: Avoid Troubles on Wet Roads

Rachel Booth death: Family tribute to 'cherished' and 'loving' mum

DWP issues Energy Support Scheme scam text alert to everyone who pays bills

'Kisanputra denied farewell': Congress questions Jagdeep Dhankhar's abrupt resignation, slams PM Modi's 'non-post'