After reporting a loss of INR 14.78 Cr in Q3 FY24, many believed FirstCry was turning the corner towards profitability. But in Q4 FY25, the kids-focussed retailer posted a sharp rise in losses — ballooning 8X QoQ to INR 111.5 Cr, primarily due to ESOP-related expenses.

Excluding ESOP costs and related taxes, the ecommerce giant would have reported a narrower loss of INR 29.2 Cr, compared to an adjusted profit of INR 90 Lakh in Q4 FY24.

Breaking down the Q4 losses:

- Consolidated net loss jumped 157.8% YoY and 656.7% QoQ to INR 111.5 Cr

- It incurred an exceptional loss of INR 36.7 Cr, stemming from a fire incident, bad debts, and asset impairment

- ESOP expenses surged 86% YoY to INR 82.3 Cr

Despite the spike in losses, revenue rose 15.8% YoY to INR 1,930.3 Cr, and adjusted EBITDA grew 20% to INR 101 Cr — suggesting strong performance in its core operations.

A quick look at full year (FY25) performance:

- Revenue from ops rose 18.2% YoY to INR 7,659.6 Cr

- Loss declined 17.6% to INR 264.8 Cr

- Its India multi-channel segment turned profitable and reported an operating revenue of INR 5,279 Cr with an adjusted EBITDA of about INR 500 Cr

- The international segment locked INR 859 Cr in revenue, while adjusted EBITDA loss was almost flat YoY at INR 140 Cr

FirstCry’s Global Bet: Despite ongoing losses, FirstCry is doubling down on its international business, where gross margins have hit 23.3% in just four years — a milestone that took seven years in India. The board has approved INR 74 Cr for expanding its UAE and Saudi Arabia operations. CEO Supam Maheshwari expects sustained momentum, with global brands growing at over 30% YoY, to be a key lever as FirstCry eyes profitability.

With faster deliveries also on the cards, will FirstCry be able to cull its losses anytime soon? While that is a question to ponder,

From The Editor’s Desk: The D2C pet care brand has secured the funding in a round from F&B giant Nestle. The company was valued at $600 Mn during its last funding round back in 2023, when it raised $60 Mn from L Catterton.

: The coworking space provider’s consolidated net profit surged 8X to INR 11.2 Cr in Q4 FY25 from INR 1.4 Cr in the year-ago period. The company’s operating revenue grew 46% YoY to INR 339.7 Cr in the quarter under review.

: The investment tech startup has filed its DRHP with the SEBI via the confidential pre-filing route. The startup is planning to raise anywhere between $700 Mn to $1 Bn through the public listing at a $8 Bn valuation.

The consumer internet company’s board has passed a resolution to infuse the capital into its latest fund, Info Edge Venture Investment Fund III. The investment major has previously backed the likes of Eternal, PB Fintech, and others.

The hyperlocal services platform is planning to raise the funds as part of its Series B round led by Lightspeed Ventures, with participation from other existing investors. The startup offers services such as cleaning, laundry, kitchen needs, and more.

The gaming major’s consolidated profit halved to INR 4.1 Cr in Q4 FY25 from INR 8.9 Cr in the preceding quarter. Meanwhile, Nazara’s operating revenue dipped 3% sequentially to INR 520.2 Cr during the quarter under review.

? The quick commerce major’s cofounder and CEO Aadit Palicha has accused the CFO of a rival quick commerce company of running a negative campaign against Zepto on social media platforms.

: The consolidated net profit of the travel tech SaaS company increased 9.6% to INR 54.8 Cr in Q4 FY25 from INR 50 Cr in the year-ago quarter. Its operating revenue grew 2% YoY to INR 260.7 Cr during the quarter under review.

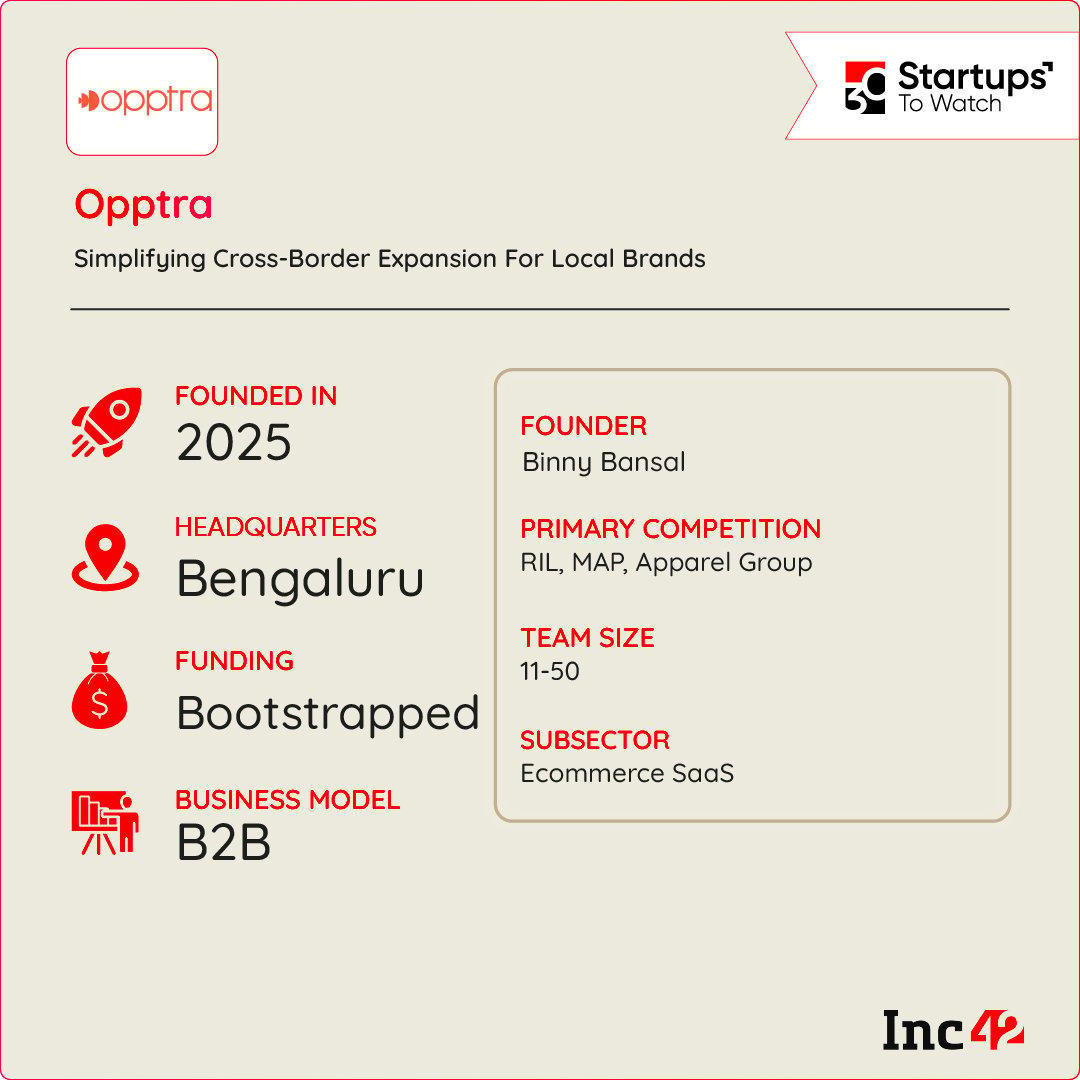

Inc42 Startup Spotlight How Opptra Is Helping Consumer Brands Achieve Cross-Border SuccessHomegrown consumer brands in India often struggle to expand internationally due to multiple challenges, from handling cross-border payments and regulatory compliance to understanding unfamiliar consumer behaviour. During his time building Flipkart, Binny Bansal experienced these bottlenecks firsthand.

To solve this, Bansal launched Opptra in 2024 — a startup focussed on helping Indian brands go global through a unique franchising model.

The Solution: Opptra aims to create a network of franchising businesses with deep local expertise, backed by shared global supply-chain infrastructure and technology. These franchisees will offer end-to-end support, including market research, go-to-market strategies, local branding, distribution, tech integration, and customer support.

Early Wins: The Bengaluru-based startup has already made headway, enabling Ghaziabad-based D2C label Exporio to enter GCC markets and helping Kochi-based home appliance brand Terraspan expand into both GCC and Southeast Asia.

What’s Ahead? With a seasoned leadership team that includes ex-Amazon director Ranjit Babu and former Lendingkart CTO Giridhar Yasa, Opptra’s franchisee-led expansion model seems promising.

The post appeared first on .

You may also like

'Here's your death penalty': Texas governor calls for execution of illegal immigrants arrested for killing of air force recruit

Rahul Gandhi Speaks To Family Of Gangrape-Murder Victim In Khandwa

Cassie welcomes baby with husband Alex Fine weeks after testifying at Diddy trial

Big Nintendo exclusive gets a Switch 2 release date with pre-orders about to go live

Emma Raducanu feeling 'constant pressure' as Brit opens up after horror French Open exit