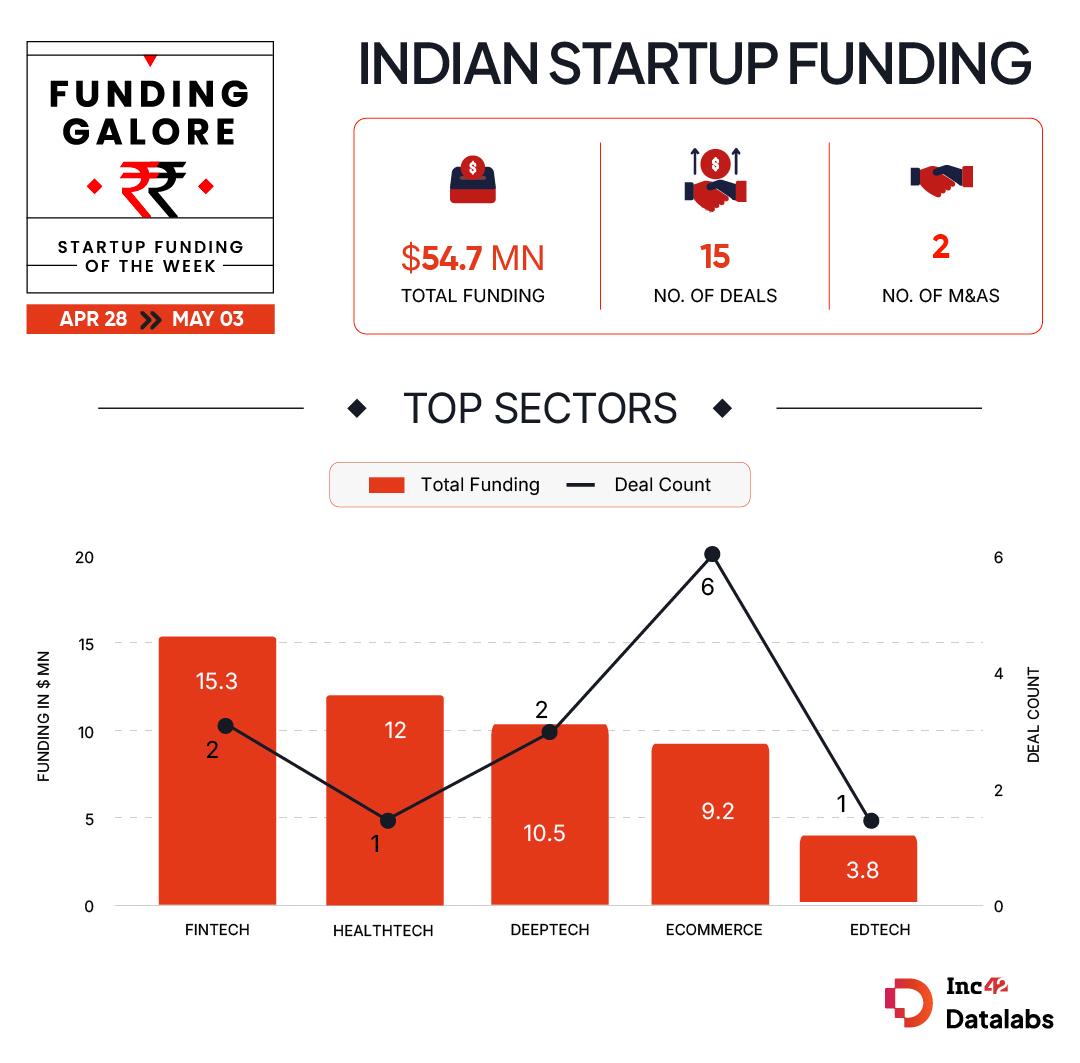

The ghosts of alleged financial mismanagement and corporate governance lapses continued to dent private investor sentiment in the world’s third largest startup ecosystem this week. Between April 28 and May 3, Indian startups managed to raise a mere $54.7 Mn across 15 deals, down 46% from the $100.3 Mn raised by 18 startups last week.

This marked the lowest week of private investment in the Indian startup ecosystem in 2025, barring the first week of January. However, the week saw Urban Company becoming the first company to file for an IPO this year. Meanwhile, Ather Energy’s IPO closed this week with a lukewarm investor interest. With this, Ather will become the first startup to get listed on the bourses this year.

With that said, here’s a look at what happened in the Indian startup ecosystem over the week.

Funding Galore: Indian Startup Funding Of The Week [ Apr 28 – May 3 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 30 Apr 2025 | HexaHealth | Healthtech | Healthcare Services | B2C | $12 Mn | Series A | Orios Venture Partners, 3one4 Capital, Enzia Ventures, ITI Growth Opportunities Fund, Chiratae Ventures, Omidyar Network India | Orios Venture Partners, 3one4 Capital |

| 29 Apr 2025 | Metafin | Fintech | Lending Tech | B2B-B2C | $10 Mn | Series A | Vertex Ventures Southeast Asia and India, Northern Arc, AU Small Finance Bank, Prime Venture Partners, Varanium Capital | Vertex Ventures Southeast Asia and India |

| 30 Apr 2025 | QNu Labs | Deeptech | – | B2B | $7 Mn | Series A | National Quantum Mission, Lucky Investment, Speciale Invest, Tenacity Ventures, Singularity AMC | National Quantum Mission |

| 30 Apr 2025 | Anveshan | Ecommerce | D2C | B2C | $6 Mn | Series A | Wipro Consumer Care Ventures, DSG Consumer Partners, Titan Capital, Force Ventures, Aman Gupta, Sameer Mehta | Wipro Consumer Care Ventures |

| 2 May 2025 | Kaleidofin | Fintech | Lending Tech | B2B | $5.3 Mn | – | IDH Farmfit Fund | IDH Farmfit Fund |

| 30 Apr 2025 | Stimuler | Edtech | Skill Development | B2C | $3.8 Mn | Pre-Series A | Lightspeed, SWC Global, M Venture Partners, Rebright Partners, Force Ventures, gradCapital, Operators Studio | Lightspeed, SWC Global |

| 30 Apr 2025 | SatLeo Labs | Deeptech | Spacetech | B2B | $3.3 Mn | Pre-Series A | Merak Ventures, Huddle Ventures, GVFL, Java Capital, IIMA Ventures, PointOne Capital | Merak Ventures |

| 28 Apr 2025 | Mugafi | Media & Entertainment | Digital Contnet | B2B | $3 Mn | Seed | StartupXseed, Auxano Capital, Proneur Network, Mars Shot Ventures, Beyond Venture Partners, We Founder Circle | StartupXseed |

| 29 Apr 2025 | Primebook | Ecommerce | D2C | B2C | $2 Mn | Pre-Series A | Inflection Point Ventures, Auxano Capital, nexG Devices, Rikant Pittie, Bhavesh Gupta | – |

| 1 Apr 2025 | EZStays | Travel Tech | Accommodation | B2C | $1 Mn | – | Finvolve, India Accelerator | – |

| 28 Apr 2025 | Malaki | Ecommerce | D2C | B2C | $675K | Seed | Venture Catalysts, Maarc Ventures, Dadachanji Family Office | Venture Catalysts |

| 29 Apr 2025 | Scandalous Foods | Ecommerce | B2B Ecommerce | B2B | $237K* | Seed | New Age India Fund | New Age India Fund |

| 30 Apr 2025 | IVANA Jewels | Ecommerce | D2C | B2C | $237K | Seed | Avinya Ventures | Avinya Ventures |

| 30 Apr 2025 | Vividobots | Deeptech | Robotics | B2B | $174K | Seed | Inflection Point Ventures | Inflection Point Ventures |

| 29 Apr 2025 | Beat22 | Ecommerce | B2B Ecommerce | B2B | – | Pre-Seed | SucSEED Indovation Fund, Chandigarh Angel Network, Prateek Toshniwal | SucSEED Indovation Fund |

| Source: Inc42 *Part of a larger round **Included this week as it was skipped last week Note: Only disclosed funding rounds have been included |

- With Metafin raising $10 Mn and Kaleidofin’s $5.3 Mn fundraise, fintech emerged as the most funded sector this week.

- Deeptech sector saw a capital infusion of $10.5 Mn this week, making it the third most funded sector this week. Important to note that the sector has been seeing a heightened investor interest since a debate was triggered over the sector’s state last month post commerce minister Piyush Goyal’s remarks.

- Over the past week, Inflection Point Ventures and Auxano Capital emerged as the most active investors, backing two startups apiece.

- Six startups at the seed stage managed to raise $3.4 Mn this week, down 79% from last week’s $16.1 Mn raised by 9 startups at this stage.

- Ather Energy’s public issue closed with an, with investors bidding for 7.65 Cr shares as against 5.34 Cr shares on offer.

- Urban Company filed its draft red herring prospectus for an. The IPO will comprise a fresh issue of up to INR 429 Cr, a near 19% reduction from the limit set by the company’s board.

- Fashion brand to consolidate its dominance in the pop culture merchandise space.

- Marking its third acquisition this year, fintech unicorn to strengthen its claims management in the healthcare insurance sector.

- IPO-bound via a rights issue this week.

- Ahead of putting its reverse flipping plan in motion, Livspace saw a from its Singapore-based parent entity.

- Zepto is said to be in advanced talks with Edelweiss Alternative Asset, domestic family offices and smaller credit funds

- Networking platform Medial is in in its Series A round from investors OG Capital and two major VC firms.

The post appeared first on .

You may also like

'BJP regime fears questions': CM Stalin takes shot at Centre over India's rank in Global Press Freedom Index

Pep Guardiola responds to Kevin De Bruyne's public Man City criticism

Health Tips: Do not do these five things even by mistake immediately after eating food, it causes great harm to health..

After banning imports, India now bars Pakistani ships from entering its ports

Raising productivity and investment will be the key to accelerate economic growth: NITI Aayog's Suman Bery