Ola Electric’s loss-making spree extended into Q4 FY25 as well. The EV maker’s net losses doubled as “execution challenges” and intensifying competition took a toll on its sales and ate into its market share.

Overall, the OEM’s net loss skyrocketed 109% YoY to INR 870 Cr in Q4 FY25 while operating revenue crashed 62% YoY to INR 611 Cr.

Meanwhile, here are the key takeaways from Ola Electric’s full FY25:

- Net losses surged 44% YoY to INR 2,276 Cr

- Top line shrunk 10% YoY to INR 4,514 Cr

- Ola Electric sold 3.59 Lakh units as against 3.29 Lakh in FY24

Why Sales Fell Off A Cliff: The EV maker attributed the subdued Q4 to the “diminished” pace of EV penetration in India in FY25 and increased competitive intensity from traditional OEMs. What did not help was the one-time exceptional loss of INR 250 Cr (due to warranty provisions) and operational challenges in scaling up its D2C sales and service network.

Course Correction: Assuring investors, founder and CEO Bhavish Aggarwal said that in terms of regulatory issues, and the company is now laser-focussed on “scaling revenue and operating leverage”. This, it plans to do by vertical integration, scaling up battery production, phasing out reliance on third-party registration agents and being “thoughtful” about capital allocation and operating risks.

Despite the rise in losses, Ola Electric claims that its auto business is on track to turn EBITDA profitable in FY26, with Aggarwal projecting a timeline of June-July 2025. While it remains to be seen whether the EV maker is able to correct its course to offset the deepening burn, .

From The Editor’s Desk: The fintech major has completed the merger of its Delaware-registered parent entity with its Indian subsidiary, Razorpay Software India Pvt Ltd. Last month, the startup became a public entity in preparation for its IPO.

: Venture capitalists in India are exploring patient capital to back innovation-first startups in deeptech, climate tech and other sectors. Once tied to impact funding, patient capital is now seen as a viable route to venture-grade returns.

: The D2C fashion brand is raising funds in a fresh round led by 360 Asset Management Fund, with participation from IvyCap Ventures and SWC Global. Snitch’s operating revenue zoomed 127.89% YoY to INR 243 Cr in FY24.

: The travel tech company reported a consolidated net profit of INR 15.2 Cr in Q4 FY25, up 172% from INR 5.6 Cr in the year-ago quarter. Operating revenue zoomed 87% to INR 218.9 Cr from INR 107.7 Cr in Q4 FY24.

The quick fashion startup is in talks to raise its maiden funding in a round led by Kae Capital, with participation from WEH Ventures and All In Capital. The startup delivers fashion products to customers in 60 minutes.

The fintech unicorn’s profit surged 16.71% to INR 339.15 Cr in FY25 from INR 290.57 Cr in the previous fiscal year. Meanwhile, its operating revenue expanded 33.66% YoY to INR 1,207.44 Cr during the period under review.

: The apex court has admitted the cases filed by the promoters of BYJU’S against the ongoing insolvency proceedings at the edtech startup. The SC also sent notices to lender GLAS Trust and the former and current IRPs of the edtech platform.

The fintech unicorn has changed the name of its parent company from Whizdm Innovations Private Limited to Moneyview Private Limited. The startup is gearing up for its IPO and plans to raise $400 Mn via public listing.

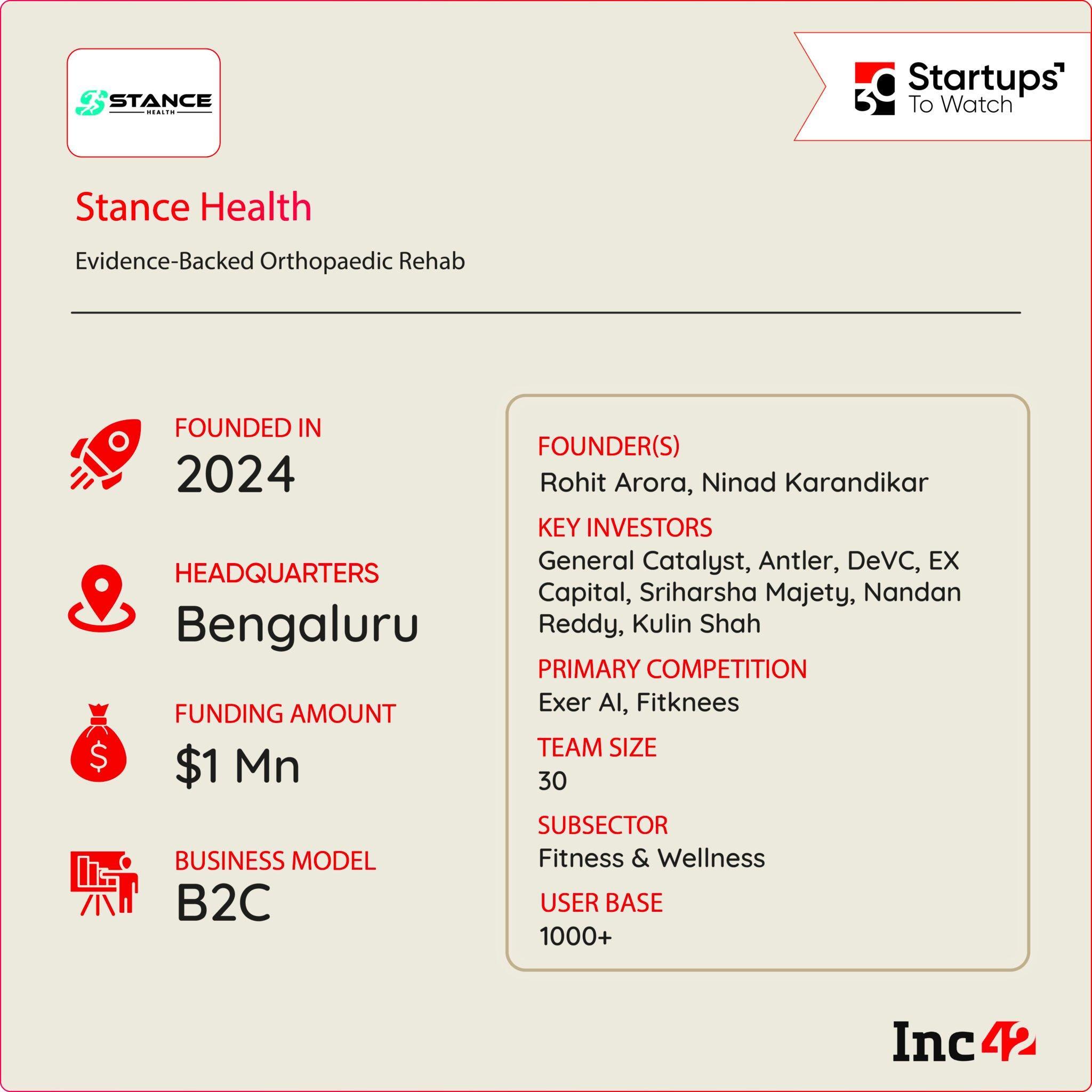

Inc42 Startup Spotlight Can Stance Health Usher In A New Era To Reverse Muscle Injuries?More than 210 Mn Indians are affected by musculoskeletal (MSK) conditions, which impact the proper functioning of muscles, bones, and joints. After facing a sports injury himself, Rohit Arora saw a major gap in the recovery-focussed MSK care market in India. To solve this, he joined hands with his college friend Ninad Karandikar to launch Stance Health in 2024.

Healing The Stance Way: The Bengaluru-based healthtech startup is focussed on long-term recovery and prevention of MSK conditions. Stance offers a full-stack solution that combines physical care centres with online engagement. Its approach covers structured diagnosis, treatment, and rehabilitation through a three-phase recovery process.

Using AI To Deliver MSK Care: The platform uses AI-powered diagnostics and personalised therapy plans to deliver measurable results. Within just one year, Stance Health claims to have delivered around 12,000 therapy sessions. It has also raised $1 Mn in pre-seed funding.

The Billion-Dollar Opportunity: With India’s healthtech market expected to touch $60 Bn by FY28, MSK care is emerging as a critical pillar of this growth. But, by blending AI-driven tools with human-led care,

The post appeared first on .

You may also like

Asia Pacific emerges as largest market for solar photovoltaic, India a bright spot

Mumbai News: Special Court Denies Bail To Gangster Chhota Rajan In 2005 Arms Recovery Case

Nitish or Nitesh? How two men with similar names caused massive jail blunder, letting rape accused walk free

ICAI CA September 2025 Exam Schedule Out: Check Dates For Foundation, Intermediate & Final Courses

Sreeleela's engagement rumours: Truth behind viral photos