PhonePe is firing on all cylinders. In FY25, the fintech giant crossed the INR 7,000 Cr revenue milestone while also slashing its losses, showcasing a rare balance of strong growth and financial discipline. So, how did PhonePe fare in FY25?

A snapshot of key financial metrics for FY25:

- Operating revenue zoomed 40.5% YoY to INR 7,114.8 Cr

- Losses narrowed 13.5% YoY to INR 1,727.4 Cr

- Total expenses rose 21.2% YoY to INR 9,394 Cr

- EBITDA loss declined 54% YoY to INR 413.6 Cr while EBITDA margin improved to -6% from -18% in FY24.

PhonePe’s New Growth Engines: While its core payments business remained the bedrock, contributing over INR 6,200 Cr to its top line in FY25, the real story lies in PhonePe’s diversification bid.

Revenue from its nascent insurance and lending services skyrocketed 207% YoY to INR 557 Cr. This signals PhonePe’s strategic transformation from a simple payments app into a multifaceted financial services platform, with multiple, high-margin revenue streams.

The IPO Ambition: The positive numbers are expected to be a shot in the arm for PhonePe, which is preparing to file its DRHP with SEBI via the confidential route later this month. The fintech juggernaut is eyeing an IPO of INR 10,000 Cr to INR 13,000 Cr at a valuation of INR 88,000 Cr to INR 1 Lakh Cr.

The public issue will likely combine a fresh issue and partial exits for investors like Tiger Global and General Atlantic, while Walmart will continue to retain majority control.

As the fintech giant approaches its D-Street debut with strong revenue growth and improving unit economics, all eyes will be on whether PhonePe can achieve profitability while staving off competition. While you ponder, here is a lowdown on PhonePe’s FY25 performance.

From The Editor’s DeskPurple Style Labs Files DRHP: Pernia’s Pop Up Shop’s parent has filed its draft IPO papers with SEBI for a listing, which will solely comprise a fresh issue worth INR 660 Cr. The company reported a net loss of INR 189 Cr in FY25, up 4X YoY, against a revenue of INR 490 Cr.

Ultrahuman’s Showstopping FY25: The smart ring manufacturer’s revenue soared nearly 5X to INR 564.7 Cr in FY25 compared to INR 104.6 Cr in the previous fiscal year. The startup also recorded a net profit of INR 71.5 Cr against a loss of INR 37.7 Cr in FY24.

Chakr Innovation Nets $23 Mn: The ONGC-backed climate tech startup has raised INR 193.5 Cr in its Series C round led by Iron Pillar. Chakr’s flagship offering is an emission control device for diesel generators to mitigate air pollution.

888VC Floats INR 175 Cr Fund: The cross-border investment firm has launched its maiden fund to back homegrown, early stage deeptech startups across sectors such as AI and sustainability. It plans to dish out cheques in the range of INR 2 Cr to INR 4 Cr.

Evera Eyes BluSmart EVs: The EV ride-hailing platform has proposed a monthly lease arrangement with Gensol Engineering’s resolution professional to snap up BluSmart’s 1,000 cabs. Evera has so far acquired more than 500 cabs of the troubled mobility startup.

Adda247’s Mixed FY25: The edtech startup’s operating revenue declined marginally to INR 217.10 Cr in FY25 from INR 219 Cr in the previous fiscal year. However, losses grew 2.5% YoY to INR 103.6 Cr in the fiscal year under review.

Aequs’ IPO Gets SEBI Nod: The contract manufacturing company has received the approval from the market regulator for its INR 1,700 Cr listing. Aequs, which filed its confidential DRHP in June, supplies components to Airbus, Boeing, Safran, Dassault, and others.

EMT To Up Stake In Eco Hotels: The OTA plans to acquire an additional 7.77% stake in the hotel chain for INR 1.5 Cr. With this, EMT’s stake will increase to 20.77%. The listed OTA has applied to subscribe to 10 Lakh shares of Eco Hotels for INR 15.2 each.

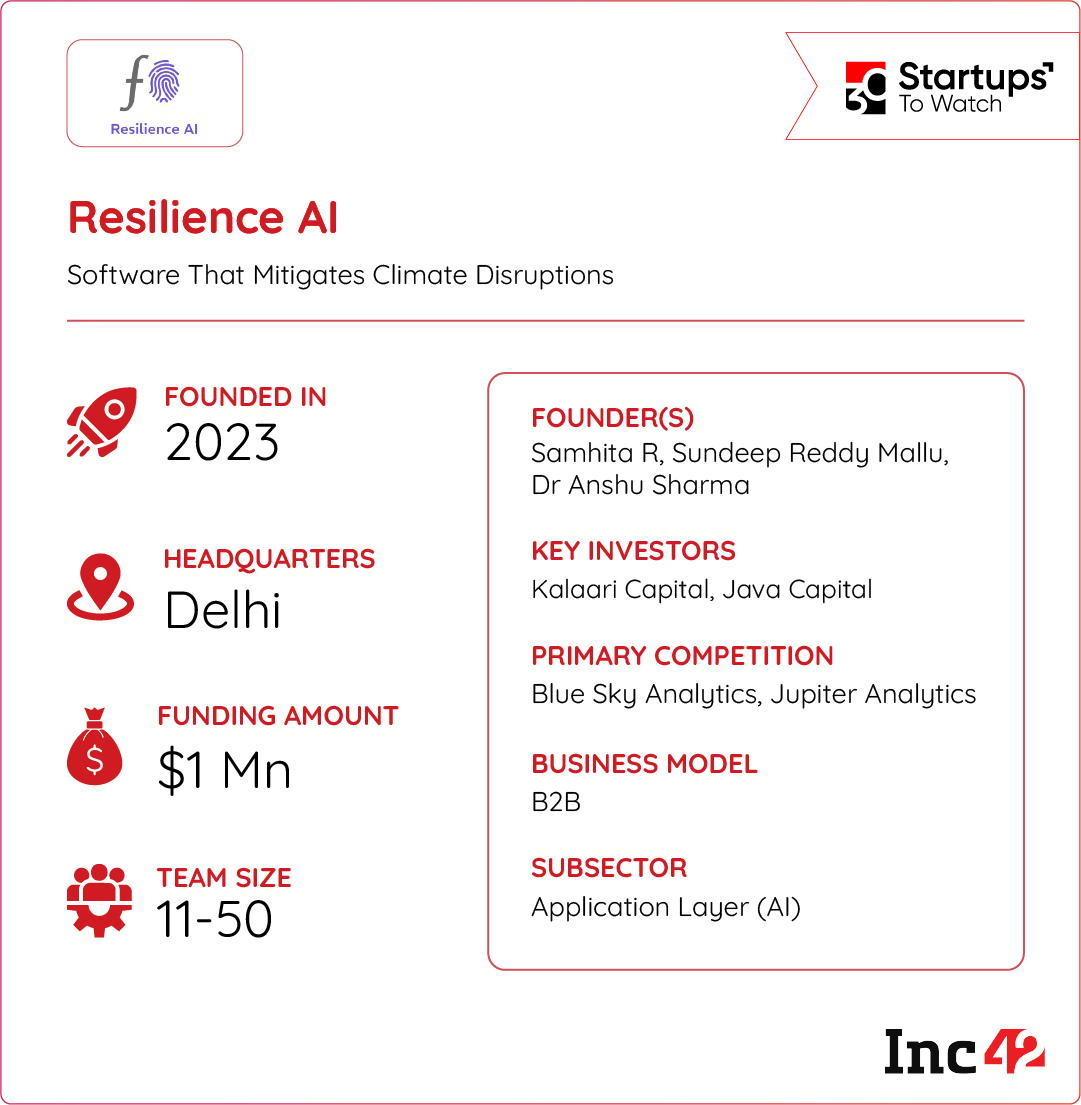

Inc42 Startup Spotlight A Climate Tech Shield For EnterprisesAs the threat of extreme climate change and disasters escalates, most businesses still lack the tools to proactively assess and manage their climate risks, leaving their critical infrastructure and supply chains vulnerable. Addressing this vulnerability is Resilience, a startup leveraging AI to help enterprises build a data-driven defence against climate change.

AI Shield for Physical Assets: The SaaS startup’s flagship platform, Resilience360, helps businesses assess climate risks, create actionable adaptation plans and enable continuous monitoring. By analysing a combination of geospatial data sets and manually collected information, the platform provides a comprehensive risk assessment, assigning a quantifiable score to each structure.

Tapping Into A $35 Bn Market: To date, the startup claims to have assessed nearly 4 Mn structures, helping businesses mitigate the impact of climate disasters. With the global climate risk and resilience solutions market projected to become a $104 Bn opportunity by 2032, can Resilience AI become the protective shield enterprises need against climate risks?

The post PhonePe’s INR 7K Cr Run, Purple Style Labs’ IPO & More appeared first on Inc42 Media.

You may also like

Fraudulent Scheme Targets Interior Decorator in Maharashtra

Telecom Regulatory Authority Of India Issues Draft, Invites Public Comments For Framework Scheduled To Come Into Effect From April 1, 2026

Kolkata Rains: 5 Dead As Heavy Showers Cause Flood-Like Condition; Metro Services Disrupted; VIDEOS

Doval-Drouin talks spark breakthrough as Canada moves against Khalistan terrorists

Trump to take aim at 'globalist institutions,' make case for his foreign policy record in UN speech