All decks have been cleared for Urban Company’s IPO. Within hours of receiving SEBI’s nod for its listing, the hyperlocal services giant has now filed its RHP for an INR 1,900 Cr public listing. So, how does the Urban Company IPO stack up?

The IPO Booster Shot: Compared to its DRHP, Urban Company has now increased the size of its fresh issue by 10% to INR 472 Cr while trimming its OFS component by 3% to INR 1,428 Cr. The company’s public issue will now open on September 10 and close on September 12, with a tentative listing date of September 17.

In its RHP, the company also revealed details of its financial performance:

- It minted a net profit of INR 239.7 Cr in FY25, helped by a deferred tax credit of INR 211 Cr, against a net loss of INR 92.7 Cr in FY24

- Operating revenue rose 38% YoY to INR 1,144.5 Cr in FY25

- Annual transacting users jumped nearly 18% YoY to 6.78 Mn during the fiscal year

- In Q1 FY26, net profit declined 45.2% YoY to INR 6.9 Cr, while operating revenue rose 31% YoY to INR 367.2 Cr

The Winning Edge: What works for Urban Company is its strong brand recall, a dominant position in the organised home and beauty services segment, a healthy profit in FY25 and a sustainable business model. Coupled with growing demand and diversified revenue streams (like water purifiers and micro home decor), the company has been able to improve both its bottom line and unit economics.

The Weak Spot: Urban Company faces competition from traditional, unorganised service providers while its international expansion continues to stifle its bottom line. The unicorn has previously also been mired in controversy over unfair working conditions for gig workers and “forcing” its products on technicians.

Amid a subdued market sentiment for startup listings this year, with names like Ather Energy, ArisInfra, IndiQube and BlueStone making lacklustre IPOs, can Urban Company pull off a scintillating show? While we ponder, here is the rundown on the unicorn’s INR 1,900 Cr public listing plans.

From The Editor’s DeskSeekho Raises $28 Mn: The short video platform has secured the funding in its Series B funding led by Bessemer Venture Partners. The startup plans to expand content formats, strengthen its AI tech stack, and scale its ‘edutainment’ offering in India.

Layoffs At Ola Krutrim: The Bhavish Aggarwal-led AI unicorn has reportedly laid off about 50 employees from its linguistics team in a fresh restructuring. This marks its third round of layoffs this year, with nearly 200 jobs gone.

Another Exit At Peak XV: MD Harshjit Sethi has quit Peak XV Partners after nearly a decade, adding to a string of senior-level departures. Sethi, who led investments in Apna and BharatPe, plans to explore new opportunities.

Flipkart’s AI Facelift: Ahead of its annual festive sale, the ecommerce major has revamped its platform. From the launch of large-format production studios to leveraging AI for content creation and customer care, Flipkart is pulling out all stops to woo customers.

Tesla’s India Order Book: Tesla has received just 600 orders since its India launch on July 15, far below expectations. Deliveries begin in September, limited to a few cities, as it scrambles to build charging infrastructure.

BigBasket CEO Denies Leadership Rejig: Hari Menon has refuted reports of a leadership change, saying there are no plans to hire a new CEO. He added the founding team remains intact and focussed on stability, innovation and growth.

DriveU Cofounder Steps Down: Ashok Shastry has stepped away from daily operations, citing personal reasons, though he remains on the board. Shastry said the startup achieved two consecutive EBITDA-positive years and has enabled over 5 Mn rides.

Venturi Partners Accumulates Dry Powder: The Singapore-based investment firm has marked the first close of its second fund at $150 Mn. The fund has a target corpus of $225 Mn. The VC counts Cult.fit, Livspace, Country Delight, K-12 Techno Services, among others, in its portfolio.

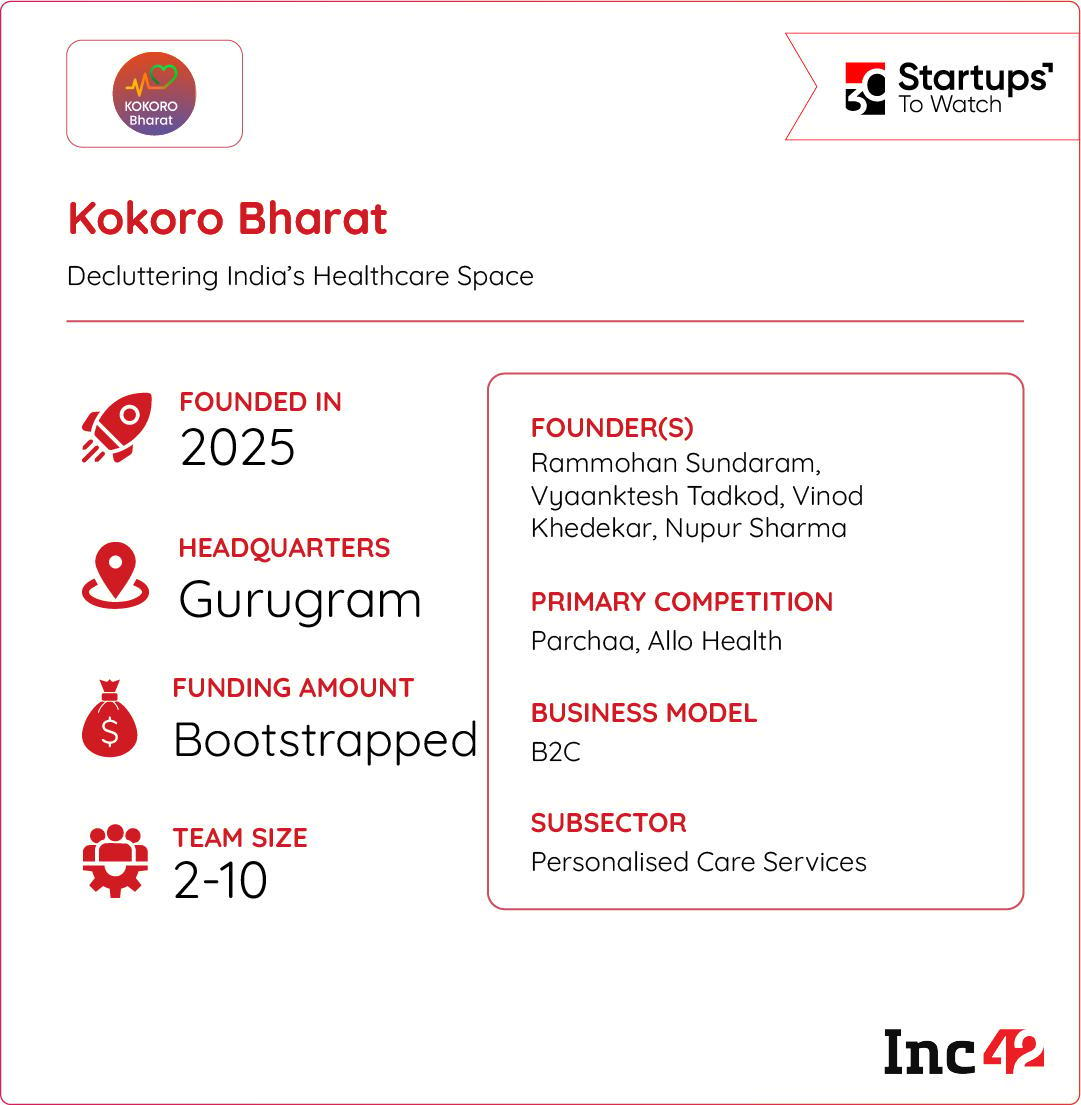

Inc42 Startup Spotlight Can Kokoro Bharat Declutter India’s Healthcare Space?India’s healthcare system is highly fragmented, which forces patients to juggle different platforms for insurance, consultations, home care, and wellness services.

The issue is even more acute in rural areas, where over 70% of India’s population lives but lacks access to proper health infrastructure. Even with the rise of digital health solutions, the absence of integration continues to strain patients financially and logistically.

Rationalising Healthcare Divide: Former DDB Mudra Group president Rammohan Sundaram is bridging this gap with his healthcare super app, Kokoro Bharat. Approved under the Ayushman Bharat Digital Mission, it brings together services like home care, insurance, and sexual wellness into one digital ecosystem. Users can also create and link their Ayushman Bharat Health Account number on the platform to securely manage medical records and access healthcare with ease.

The Big Question: India’s digital health market is expanding rapidly, backed by a strong government push through the Ayushman Bharat Mission. A unified platform like Kokoro Bharat could become a central hub for millions seeking seamless healthcare access.

By solving fragmentation and aligning with the government’s digital health vision, can Kokoro Bharat win the trust of users to truly become their one-stop healthcare platform?

The post Urban Company’s IPO, Job Cuts At Krutrim & More appeared first on Inc42 Media.

You may also like

Market of false promises: BJP slams Cong amid Pawan Khera's dual voter ID row

K'taka MLA says woman SP acts like pet dog of Cong leaders; FIR slapped by police

'Best ever' film that has fans in tears finally lands on Disney Plus

Father bought the house in the name of the elder son, now wants to transfer it to the younger one, is there a rule for this, too?

Sikandar Raza becomes No. 1 ODI all-rounder for the first time